Our Company

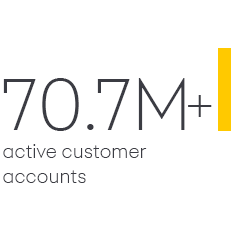

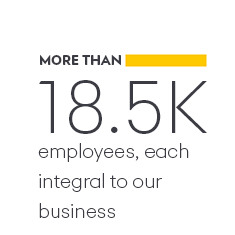

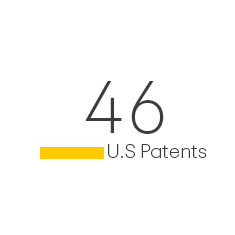

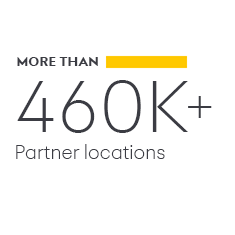

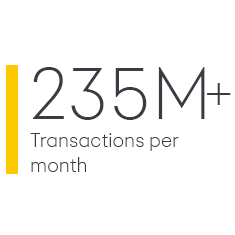

Synchrony (NYSE: SYF) is a premier consumer financial services company delivering one of the industry’s most complete digitally-enabled product suites. Our experience, expertise and scale encompass a broad spectrum of industries including digital, health and wellness, retail, telecommunications, home, auto, outdoor, pet and more. We have an established and diverse group of national and regional retailers, local merchants, manufacturers, buying groups, industry associations and healthcare service providers, which we refer to as our “partners.” We connect our partners and consumers through our dynamic financial ecosystem and provide them with a diverse set of financing solutions and innovative digital capabilities to address their specific needs and deliver seamless, omnichannel experiences. We offer the right financing products to the right customers in their channel of choice.

This structure enables us to drive faster growth, deepen our domain expertise and provide the most comprehensive suite of products in the industry.

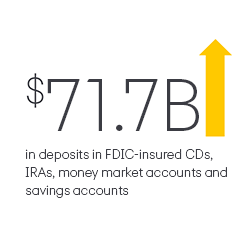

Synchrony Bank

Synchrony Bank offers savings accounts that feature award-winning products and the safety of FDIC insurance*—CDs, IRAs, Money Market Accounts and Savings Accounts. Customers can open an account in minutes via our Mobile app or online all with no minimums or monthly service fees.

Synchrony is always developing new products to help consumers achieve what’s possible. Today, we offer the Synchrony Premier World Mastercard, with 2% cash back and no annual fee, * subject to credit approval. The Synchrony Plus World Mastercard and the Synchrony Preferred Mastercard are currently offered by invitation only.

We are connected to the decisions consumers make every day about spending and saving with options to use credit or savings to make important buying and spending decisions in line with their financial goals.

*FDIC insurance up to $250,000 per depositor, per insured bank for each ownership category.